By Aly J. Yale for WSJ

If you’re financing a home with a mortgage, ensuring you get the best possible rate is one of the smartest financial moves you can make.

While it takes some legwork, the pay off is hard to argue with. Shaving even a fraction of a point from your rate can save you hundreds of dollars each month and tens of thousands over the life of the loan.

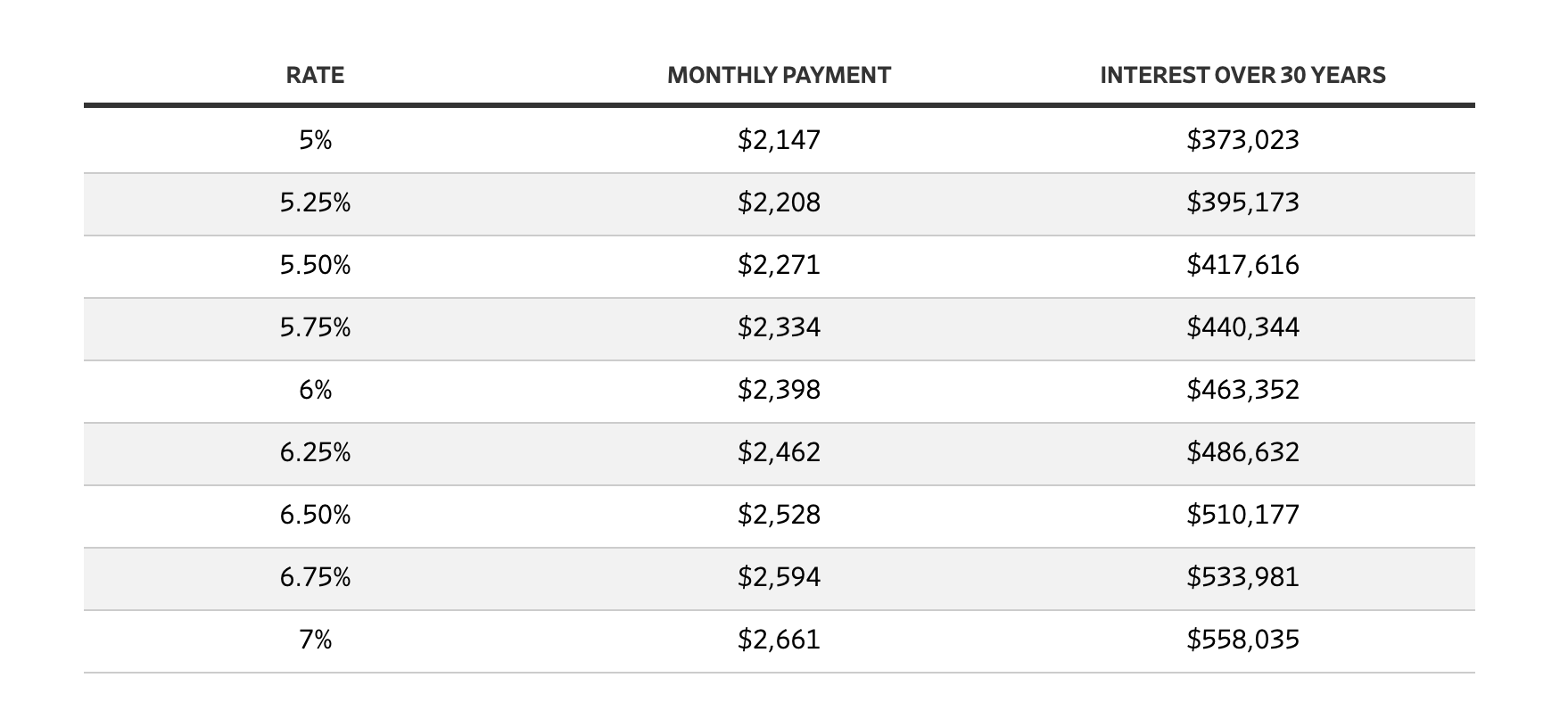

For example, with a $400,000 mortgage, dropping from a 7% to a 6.5% rate would save you almost $50,000 in interest over a 30-year term—roughly enough to pay for a year of private college.

Mortgage rates change constantly—and differ across mortgage companies. Here’s how to take advantage of those facts, compare current mortgage rates and get the best deal.

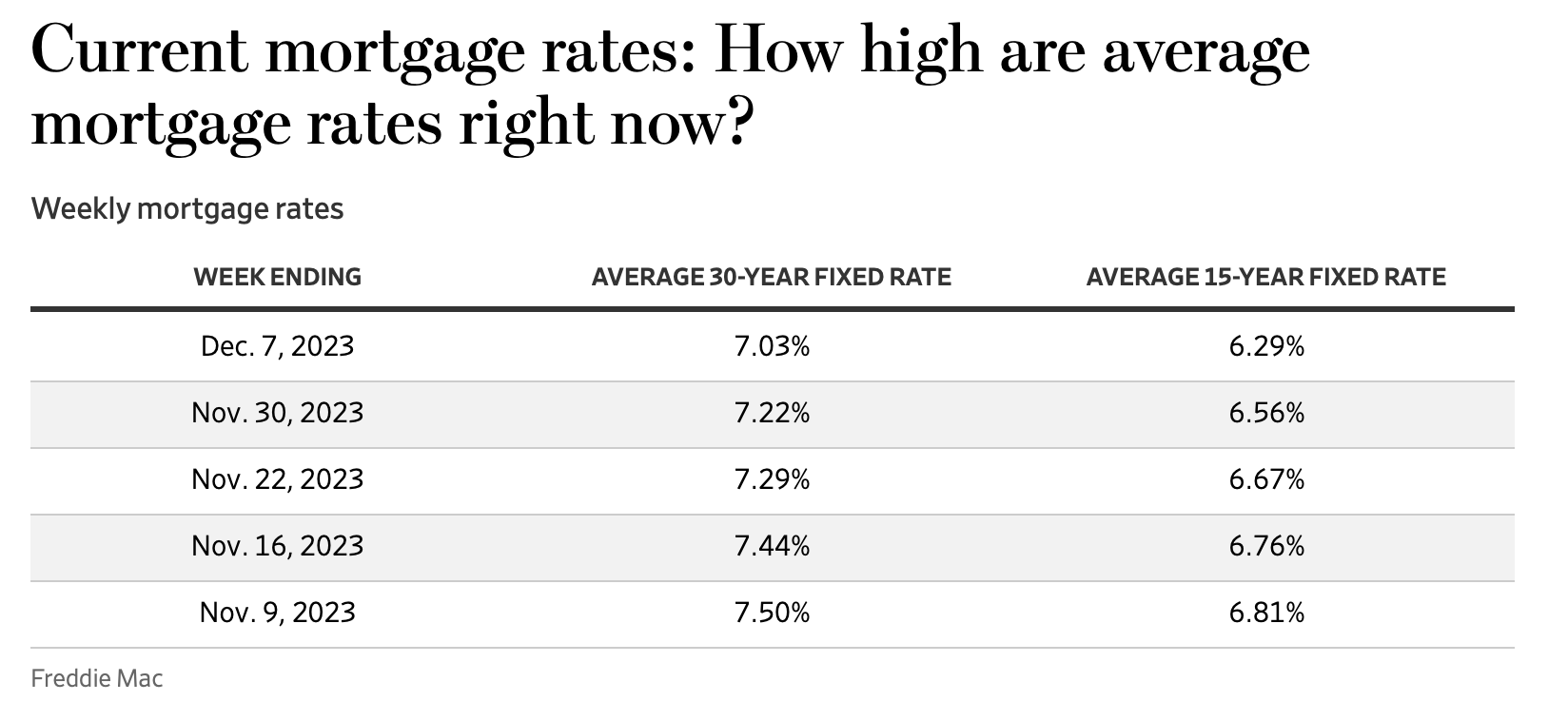

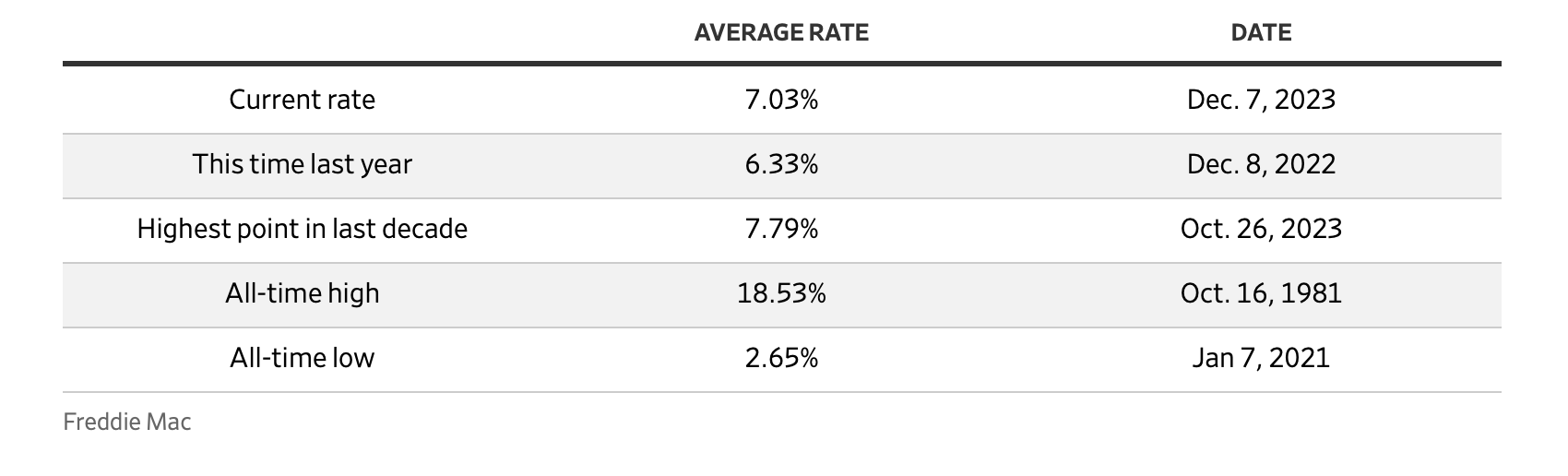

Mortgage rates cooled in November, though they still remain high compared to recent years. According to mortgage purchaser Freddie Mac, the average rate on 30-year fixed-rate mortgages fell from 7.79% at the start of the month to 7.22% today.

“The rapid half-point mortgage rate drop began when bond markets rallied after the Fed’s rate hike pause on Nov. 1 and continued when October inflation dropped,” says Jeff Taylor, founder of mortgage compliance platform Mphasis Digital Risk and a board member of trade group the Mortgage Bankers Association. (Mortgage rates have an inverse relationship with bonds, so when interest in bonds—and subsequently bond prices—rises, mortgage rates tend to fall.)

The drop in rates sparked modest renewed interest in mortgages. According to MBA, applications to purchase a home were up 5% between the last two weeks of November. Activity is still well-below year ago levels, though, and that’s because while rates have dropped in recent weeks, they aren’t exactly low. (About 83% of mortgage homeowners currently have a rate of 5% or less, according to Redfin.)

Today’s rates are, however, a far cry from the highest rates U.S. borrowers have dealt with. Those came in 1981, when rates reached nearly 19% on 30-year mortgages.

Where are mortgage rates headed?

Mortgage rates are influenced by many factors, including the economy, investments into mortgage-backed securities, the Treasury bond market, inflation and, perhaps most important in recent years, moves by the Federal Reserve.

Between March 2022 and July 2023, the Fed increased the federal-funds rate—the rate at which banks can borrow money—11 times. And over that period, 30-year mortgage rates jumped from under 4% to 7%. (To be clear: The Fed doesn’t directly set mortgage rates. Its federal-funds rate and mortgage rates tend to move in the same direction, though.)

The Fed has recently been easing off those rate hikes, opting to keep its rate as-is at the last two meetings. If inflation keeps dropping—it fell to 3.2% in October—the days of Fed rate hikes are likely behind us.

“If the Fed continues to see inflation dropping closer to their 2% target in the coming months, bond markets should respond positively, which would cause mortgage rates to ease more during 2024,” Taylor says.

Mortgage purchaser Fannie Mae currently projects the average 30-year mortgage rate will fall to 7.0% by mid-2024. MBA expects rates to drop to 6.6% by the second quarter and 6.1% by the close of 2024.

Taylor cautions would-be buyers, though: With lower rates could come other headwinds. “It would bring needed relief to home buyers,” he says. “But lower mortgage rates will also put upward pressure on home prices.”

How are mortgage rates set?

While the Fed influences mortgage rates, it is only one piece of the puzzle. Other external factors play a role, too—as do the details of your financial situation and loan choice.

Here’s what you need to know about what determines your mortgage rate.

External factors

The overall state of the economy is a big contributor to the path of mortgage rates. When the economy is strong, rates tend to be higher. When the economy sputters, rates drop.

“Interest rates often will rise or fall based on the strength of the economy, and ironically, bad news can be good news for lower interest rates,” says Bill Banfield, an executive at lender Rocket Mortgage.

This is due in part to how economic conditions impact investment activity. When there are geopolitical concerns or the economy is wavering, investors tend to flock to safer investments—which include things such as Treasury bonds and mortgage-backed securities. This pushes the yields on those securities down (yields fall when bond prices rise), taking mortgage rates down with them.

“When there is high demand for mortgage-backed securities, the prices of those MBS increase, which in turn can lower mortgage interest rates,” says Tanya Blanchard, founder of mortgage brokerage Madison Chase Capital Advisors. “This is because investors are willing to accept lower returns on their investments when the prices of MBS are high.”

Finally, inflation factors in, too—and not just because of the Fed reaction. It also increases the costs for lenders to originate loans, which drives their prices higher as well.

Personal factors

Your personal finances will factor into your interest rate as well. First, there’s your credit score. Mortgage lenders use this number to gauge your risk as a borrower—or how likely you are to default on your loan. The lower your score, the higher the rate you’ll need to pay to compensate for the perceived risk.

“Credit score is a very important consideration when applying for a mortgage,” Banfield says. “If someone has a proven track record of being responsible with their finances, they’ll be more likely to get a mortgage and a better rate.”

The size of your down payment is important, too. A larger down payment means you have more to lose, which hopefully discourages you from defaulting. Smaller down payments, on the other hand, mean more risk for the lender and higher rates for you as a result.

Loan-specific factors

Last but not least, the type of mortgage loan you choose will also influence your rate. Loans backed by the government, such as Federal Housing Administration-backed FHA loans and Veterans Affairs-backed VA loans, tend to have lower rates than conventional or jumbo loans since they come with the federal government’s protection. Shorter-term loans (15 years, for example) also have lower rates than longer-term ones (30 years).

As Goodwin explains, “While a shorter-term loan will come with a higher monthly payment, it could save you thousands on interest in the long run.”

How, when and why to compare mortgage rates from different lenders

Because every lender has different overhead costs, operating capacities and appetite for risk, mortgage rates can vary significantly from one company to the next. That’s why it’s important to consider several lenders before choosing where to get your loan.

Freddie Mac recommends getting at least four quotes (it could save you an average of $1,200 a year, apparently). Just make sure you’re not only going by the rates a lender advertises on their website or on third-party sites.

“Looking at advertised rates alone is not a good way to shop around,” Goodwin says. “Lenders typically display the lowest rates they offer as a headline to attract leads, but the actual rate you may be offered can vary dramatically depending on your own financial situation and the kind of loan you’re looking for.”

Many advertised rates also include mortgage points—meaning you would need to pay an extra upfront fee to snag it.

To get a rate that is truly a reflection of what you would pay as a borrower, you need to apply for preapproval. You’ll have to fill out an application and agree to a credit check for this. Once you’re done, you’ll get a loan estimate that will detail the total loan amount you are likely to qualify for, plus your interest rate and expected closing costs—or the fees required to originate, underwrite and close on your loan. Be sure to look at the APR, too—the annual percentage rate. This reflects the total annual cost of the loan, considering both your rate and any fees.

Be warned, though: The rates you’re quoted aren’t guaranteed until you lock your rate. A rate lock guarantees your interest rate for a set period—usually only 30 to 60 days, depending on the lender. You’ll typically do this once you’ve found a home and have a contract in place.

How to calculate your mortgage costs

Comparing mortgage offers might seem tedious, but financially, it’s usually worthwhile. Even a small change in rate can have a big impact on your monthly payment and long-term interest costs.

You can use a mortgage calculator to break down the exact costs or use your loan estimate. This should detail your monthly payment, your interest rate and your total interest paid in five years.

See the difference that incremental rate changes can make on the cost of a 30-year, $400,000 home loan below:

Keep in mind that most mortgage loans are amortized, meaning the total costs are calculated and then paid in even payments across the loan term. With these loans, you’ll pay more interest upfront and less toward the end of the term. For example, your first payment at 6% would see $2,000 go toward interest, while your final payment would have just $11.93.

“At the beginning of the loan term, the majority of the monthly payment will go toward interest,” says Colleen Bara, a lending executive with Key Bank. “As the loan is paid down, more of the monthly payment is allocated toward the pay-down of the principal balance.”

This means if you sell your home quickly after taking out your loan, you likely won’t have paid down your balance much—and may not make much from the home, profit-wise. If this is a concern, making an extra payment each year you’re in the house can help.

“Make one extra principal payment yearly and you can shave off approximately seven years of interest,” Blanchard says.

Leave a Reply